Feds Lower Interest Rate, Wall Street Falls For Record Ten Straight Days As Fewer Rate Cuts Expected For 2025

Despite the cut, Wall Street fell for 10 days in a row, marking the longest consecutive decline since 1974 as investors foresee fewer rate cuts in 2025.

FEDERAL RESERVE - The U.S. Federal Reserve has lowered the interest rate by one-quarter of a percentage point (0.25%) to between 4.25% to 4.5%.

Despite the cut, Wall Street fell for 10 days in a row, marking the longest consecutive decline since 1974 as investors foresee fewer rate cuts in light of statements by the Federal Reserve that the fight against inflation is not over.

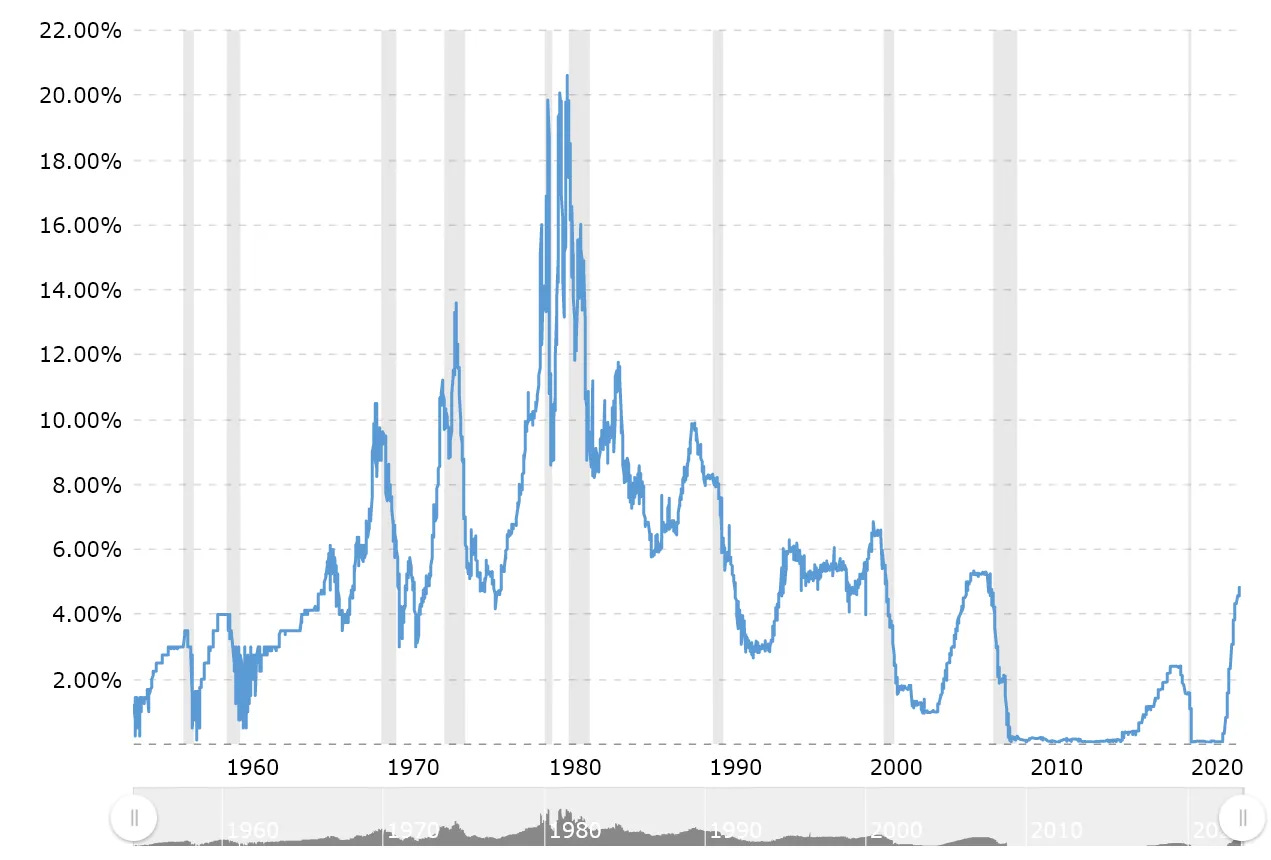

Inflation Had Reached 9.1% Before It Decreased

In order to fight inflation, which had reached a peak of 9.1% in mid-2022, the Federal Reserve was forced to raise the interest rates to its peak 5.33% in order to slow inflation down, making borrowing money cost more.

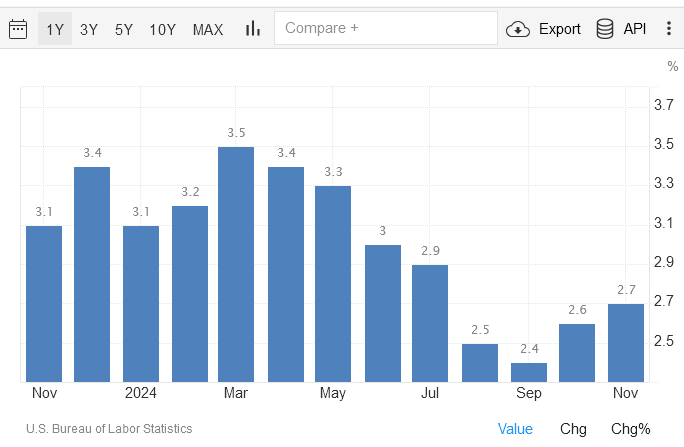

As of the month of November, 2024 the inflation rate was at 2.7%, which although has gone down since its peak, was up from 2.6% in the month of October.

A statement by the Federal Reserve said, "Inflation has eased significantly over the past two years but remains somewhat elevated relative to our 2 percent longer-run goal."

The Dow Jones Industrial (DOW) fell by 1,123 points on Wednesday, shedding 2.6% and closing at 42,327 at a 10-day losing streak, while the S&P fell by almost 3% closing at 5,872. The NASDAQ Composite fell by 3.6%, closing at 19,393.

FOMC statement, Economic Projections:

Keep reading with a 7-day free trial

Subscribe to The Standeford Journal - News, Intel Analysis to keep reading this post and get 7 days of free access to the full post archives.