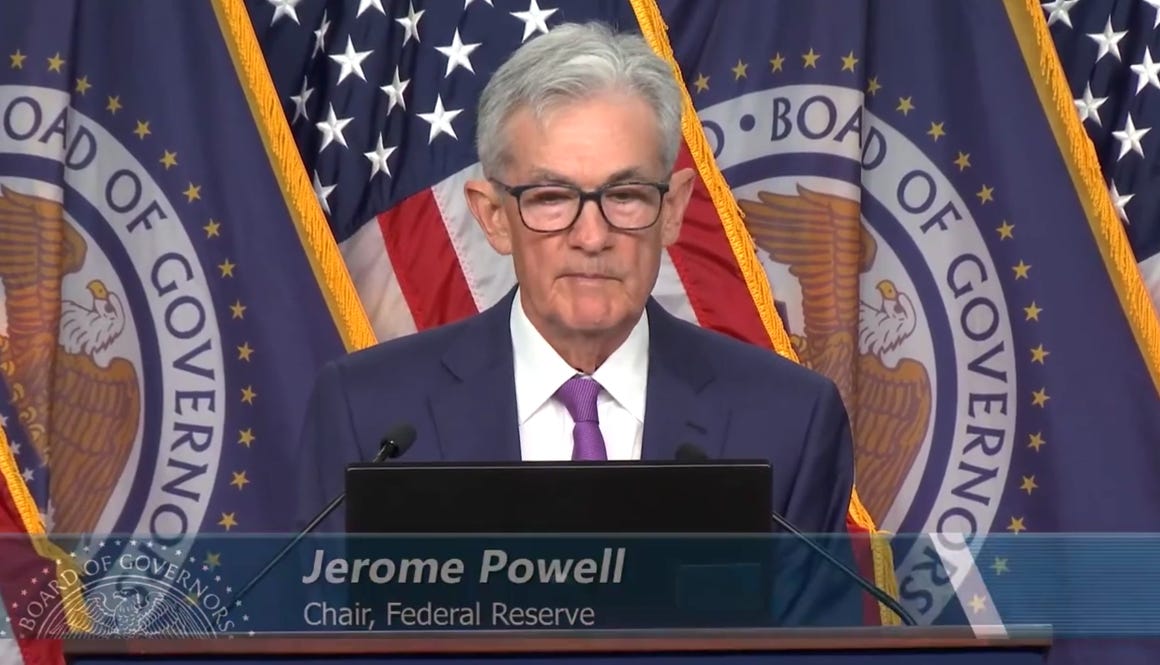

Federal Reserve: Inflation Remains Elevated. Interest Rates To Stay At 23-Year High

The Federal Reserve hopes to fight the current upward trend of price increases for goods by maintaining interest rates at the 23-year high for now.

FEDERAL RESERVE - The Federal Reserve Chair Jerome Powell has released a Federal Open Market Committee (FOMC) statement saying that although inflation has eased over the last year, it remains elevated and that there has been a lack of progress toward the Committee's inflation objective of 2%.

The FOMC statement added that the "economic outlook is uncertain, and the Committee remains highly attentive to inflation risks," and has decided neither to raise interest rates, nor lower them, but maintain them at the current rate of 5-1/4 to 5-1/2 percent.

The Federal Reserve hopes to fight the current upward trend of price increases for goods by maintaining interest rates at the 23-year high for now.

"In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks," the statement added.

It also said, "The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.

In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities."

"The Committee is strongly committed to returning inflation to its 2 percent objective," the FOMC statement said.

Federal Reserve issues FOMC statement, Opening Statement Transcripts, Video:

Keep reading with a 7-day free trial

Subscribe to The Standeford Journal - News, Intel Analysis to keep reading this post and get 7 days of free access to the full post archives.